Using the New FAFSA Form

Here are some important things that you need to know.

The Free Application for Federal Student Aid was redesigned and streamlined to make it simpler and easier to apply for financial aid.

With the new form, the federal government also changed how it processes your application.

Click on the following links or scroll down to learn more.

- This year's timeline starts Dec. 1

- You'll need to create an FSA ID account

- The new FAFSA uses some new terms that you'll want to learn

- Find more FAQs and videos below

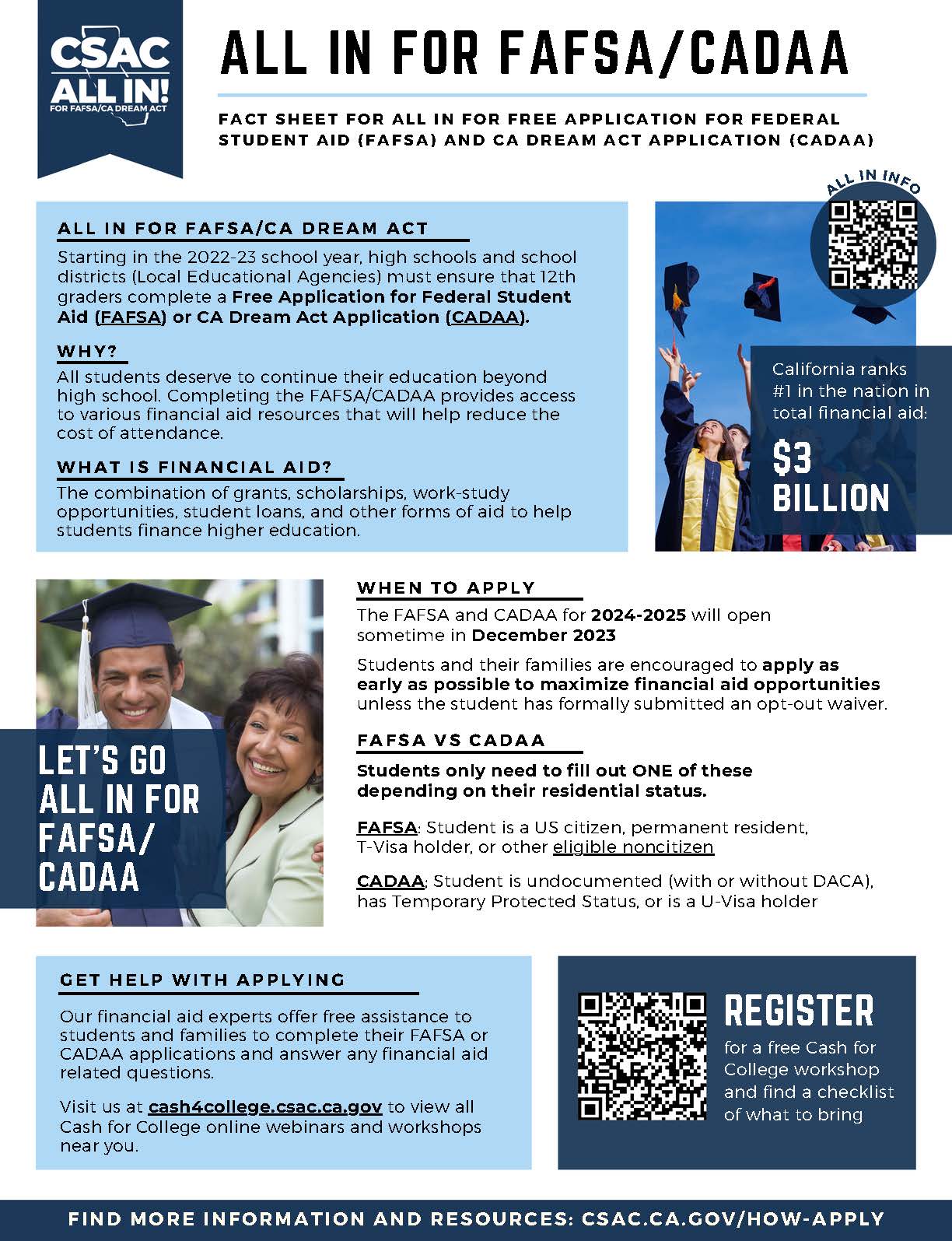

Undocumented? Use the CADAA

If you’re undocumented, don't use the FAFSA. You should use the California Dream Act Application so you can be considered for Cal Grants and other aid for which you are eligible.

This Year's Timeline Starts Dec. 1

The new form for the 2025-26 school year is available as of Dec. 1, 2024. The video below was made for last year's form, but the information still applies to this year.

You'll Need To Create an FSA ID Account

In order to use the FAFSA form, you must sign up to create an FSA ID account, if you don’t already have one.

Other individuals who are considered "contributors" (see below) – such as a parent, parent’s spouse or a student’s spouse – may also need to have an FSA ID.

There’s a new process for parents or spouses (or others) to get an FSA ID if they don’t have a Social Security number. Because there have been some glitches with the new FAFSA process, they can follow these steps instead:

- First: Download the Attestation and Validation form

- Next: Download and follow the instructions for completing the Attestation and Validation form

- Note: Students whose immigration status is undocumented should not use the FAFSA or the Attestation and Validation form – You should use the California Dream Act Application instead.

You Should Learn These New Terms

The FAFSA form uses some new terms, including "Contributors" and "Student Aid Index."

What's a contributor?

“Contributors” refers to individuals who are required to allow their federal tax information to be transferred directly into the new form.

This doesn’t necessarily mean that contributors are required to pay for your college expenses. And there may be other individuals who will need to provide some financial information for the form.

- Required contributors include you, the student, and may also include spouses, parents or step-parents, depending on your dependency status, tax filing status or marital status.

- Contributors are required to provide their consent to have their federal tax information transferred directly from the IRS into the FAFSA form. To do this, contributors will need to provide their full name, date of birth, social security number and email address. They are also required to create their own FSA ID account and to sign the FAFSA.

What's the Student Aid Index?

The Student Aid Index (SAI) has replaced the old Expected Family Contribution (EFC).

- The government is now using the new SAI as a measurement of how much you or your family are expected to contribute to college costs.

- There are some changes in the formula used to calculate this new index, including how your family size is determined.

More Information and FAQs

You’ll find more information at studentaid.gov and at csac.ca.gov/how-apply, as well as in the FAQs listed below.

You can also click to download a handy financial aid fact sheet from the California Student Aid Commission, which has been updated with information about the new FAFSA and CADAA.

We'll post more updates on this webpage as needed.

-

What else has changed with the FAFSA?

-

What isn’t changing?

-

Do I still need to input financial information manually?

-

Will there also be changes in the California Dream Act Application (CADAA)?

Want More Videos?

You'll find several helpful videos on this webpage. You can also use these buttons to find additional videos about different aspects of the new FAFSA form.